Cell banking is undoubtedly one of the vital fast-growing industries in the marketplace, the place new traits seem yearly aiming to simplify the method of sending and receiving funds. And with the heavy influences of the COVID-19 pandemic, cell banking has obtained extra consideration than ever.

1. What’s A Cell Banking App?

Cell banking apps have been experiencing vital development and adoption worldwide. The comfort and accessibility provided by these apps have made them more and more standard amongst customers. The COVID-19 pandemic additional accelerated the shift in direction of digital banking as extra folks sought distant banking options. Listed below are just a few varieties of apps coated by the cell banking class:

- Fee methods that assist to hold out transactions on-line (for instance, Paypal).

- Autonomous cell banking apps assist handle private accounts, transactions, invoice funds, and so forth.

- Analytical monetary apps additionally present private monetary analytics, class administration of bills, and so forth.

- Crypto or Shares Investing apps (for instance, Coinbase, Binance, Robinhood).

07 Prime Tendencies Of On-line Banking 2022

In recent times, cell banking has revolutionized the best way folks handle their funds. With the growing recognition of smartphones and the comfort they provide, cell banking apps have turn into a necessary a part of our each day lives. As know-how continues to evolve, so do the traits in cell banking. On this article, we are going to discover the highest seven cell banking traits that may assist take your app to the subsequent degree.

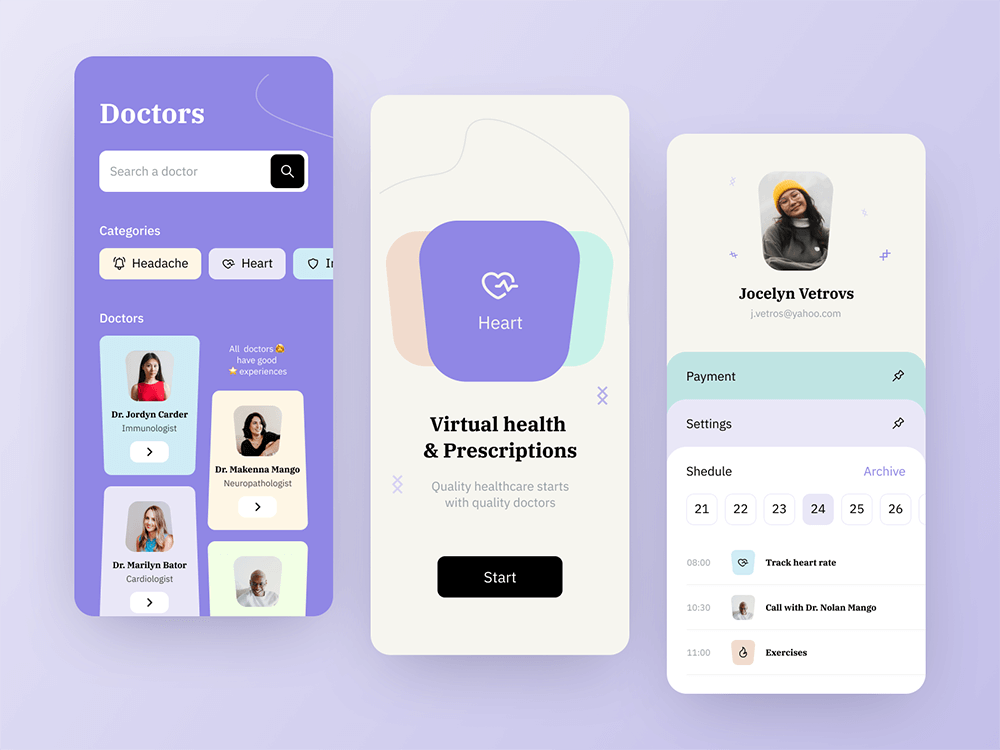

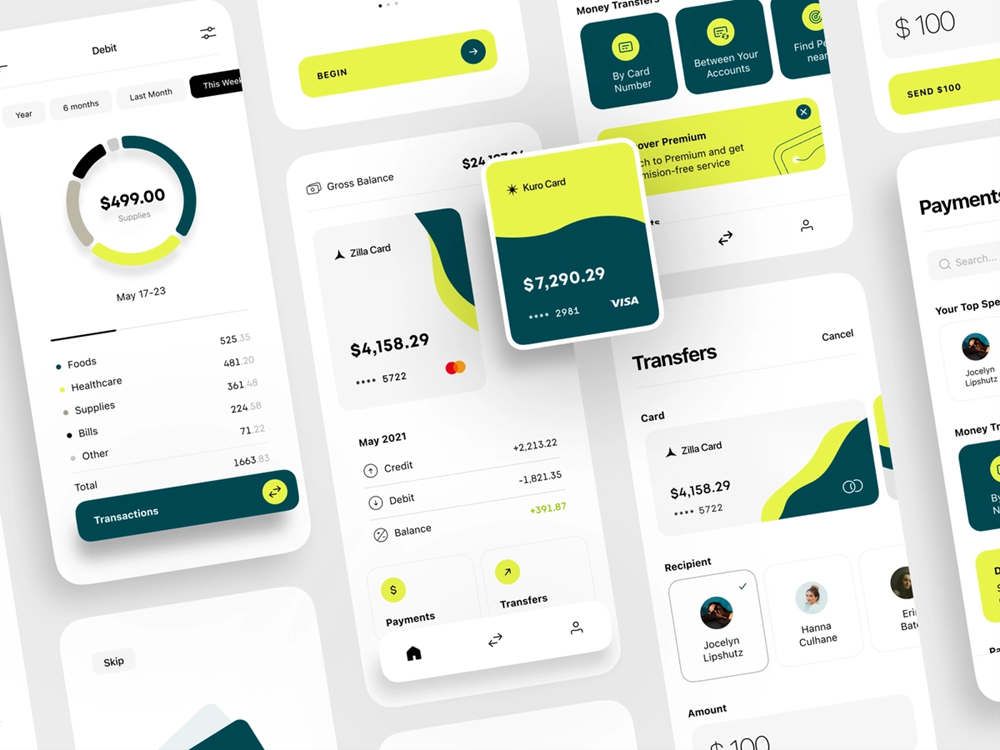

1. Consumer-Centric Expertise

It’s no secret that over the past 15 years or so, all user-targeted providers have undergone a revolution. The main position in such providers has shifted to customers moderately than the standard of service itself.

You should not have to construct a brilliant tech-savvy and complex service to turn into a person’s favourite. Succesful Companies these days gravitate in direction of a cell banking app with handy, together with providers that can enable customers to finish their banking functions effectively, quick, and even have enjoyable sometimes.

And with a view to obtain this simplicity and smoothness, you could observe the user-centered or user-centric strategy. That is particularly necessary when your audience is Era Z and Millenials, whose knowledge is commonly extra useful than gold.

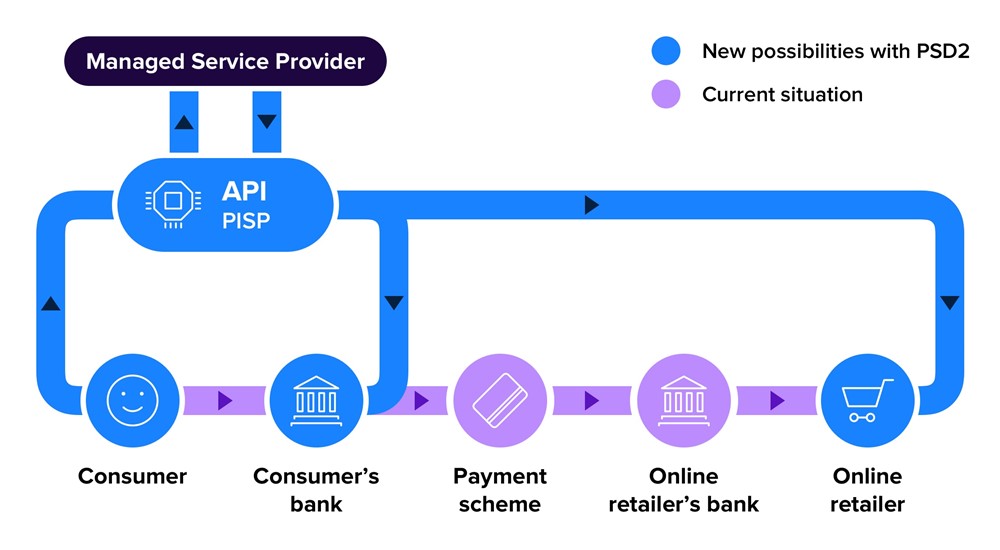

2. Open Banking API

One other pattern disrupting the business for the previous couple of years is open banking. This distinctive know-how permits a financial institution to share its banking info by way of APIs (Utility Programming Interface) to 3rd events (startups), who can use them to develop new fintech merchandise, like monetary analytics apps.

Open banking API is at the moment on a break as many international locations, like EU international locations, India or US, are introducing open API rules to streamline this course of. But, many international locations are solely on the best way to introducing open banking into their laws. Anyway, this cell banking pattern is anticipated to form the business for years forward.

3. AI And Machine Studying

There can by no means be an article about traits with out AI and Machine Studying. The factor is that each these applied sciences are standard amongst all tech industries, and on-line banking is not any exception.

Each machine studying and AI enable builders to deliver extra customization to cell banking and assist to supply a greater buyer expertise, which is crucial factor, as we talked about earlier. For instance, you might use AI on the front-end applied sciences to imitate dwell workers by way of chatbots, voice assistants, or private suggestions.

4. Large Information

Large Information is a know-how that permits the amassing and processing of enormous quantities of non-public person info. Much like AI and ML, that is extensively used for advertising, gross sales, or enhancing person expertise.

Whereas a cell banking app tracks customers’ actions in an app, by using Large Information, the system might simply spot if one thing uncommon occurs. For instance, if a major amount of cash has been cashed or deposited – or another uncommon habits for a selected person.

5. No Code/Low Code Growth

This one might be a gold mine for early-seed fintech startups. Particularly, when you could have restricted time and funds for improvement, the perfect factor to do is construct the best model of the product. In different phrases, a minimal viable product. No code/low code packages show you how to make a product’s MVP rapidly and cost-efficiently and push the product to the market as quickly as attainable.

6. Personalization

Personalization is a much less obvious cell banking pattern however no much less essential. At present it isn’t sufficient to construct a cell banking app that capabilities effectively. Making an app particularly for a selected group of individuals can also be important. For instance, a selected group that makes use of your app might be avid gamers, athletes, or animal lovers. Giving them one thing so simple as a corresponding wallpaper might be a wise solution to improve customers’ loyalty.

7. Gamification

Gamification in banking apps refers back to the incorporation of sport parts and mechanics into the person expertise to make monetary actions extra partaking, pleasing, and motivating. By leveraging sport design rules, banking apps can improve person interplay, improve buyer loyalty, and drive desired behaviors. Listed below are some key features of gamification in banking apps:

-

Rewards and Factors Methods: Banking apps can introduce reward methods, the place customers earn factors, badges, or digital forex for finishing particular actions or attaining sure milestones. These rewards might be redeemed for varied advantages, equivalent to reductions, customized presents, or entry to unique options. The buildup of factors and the pursuit of rewards create a way of feat and incentivize customers to actively have interaction with the app.

-

Progress Monitoring and Visualizations: Gamified banking apps typically present visible representations of customers’ progress, equivalent to progress bars, charts, or ranges. These visualizations enable customers to trace their monetary objectives, monitor their spending patterns, and acquire a way of management over their funds. By making progress seen and tangible, customers are motivated to proceed partaking with the app and bettering their monetary habits.

-

Challenges and Competitions: Introducing challenges or competitions throughout the banking app can encourage customers to attain particular goals or have interaction in wholesome monetary behaviors. For instance, customers could also be challenged to avoid wasting a certain quantity inside a given timeframe or scale back their spending in particular classes. Leaderboards or peer comparisons might be added to foster a way of competitors and social engagement amongst customers.

8. Integration with Fintech Companies

Collaboration with fintech corporations is a rising pattern within the cell banking business. By integrating your app with fintech providers, you’ll be able to supply customers entry to options like peer-to-peer funds, budgeting instruments, funding choices, and extra. This integration enhances the worth proposition of your cell banking app, attracting a wider buyer base and fostering innovation throughout the monetary ecosystem.

9. Enhanced Safety Measures

As cell banking turns into more and more standard, the necessity for sturdy safety measures turns into essential. Implementing applied sciences equivalent to multi-factor authentication, encryption, and real-time fraud detection helps safeguard delicate person info. Conserving abreast of the most recent safety traits and complying with business requirements builds belief amongst customers and ensures the integrity of your cell banking app.

10. Biometric Authentication in Banking Apps

Biometric authentication is a know-how that verifies the identification of a person primarily based on distinctive physiological or behavioral traits. Within the context of cell banking apps, biometric authentication has emerged as a extremely safe and handy methodology for customers to entry their accounts and authorize transactions. Let’s delve into the subject in additional depth:

-

Fingerprint Recognition: That is probably the most extensively used type of biometric authentication in cell banking. Customers can authenticate themselves by putting their finger on the system’s fingerprint sensor, which analyzes the distinctive patterns and ridges on the fingertip.

-

Facial Recognition: This methodology makes use of facial options, equivalent to the form of the face, eyes, nostril, and mouth, to confirm the person’s identification. The cell banking app captures a picture of the person’s face and matches it with the enrolled facial template to grant entry.

-

Iris Scanning: Iris scanning know-how captures the intricate patterns of the iris, the coloured a part of the attention, to confirm the person’s identification. It presents a excessive degree of accuracy and is troublesome to counterfeit.

-

Voice Recognition: Voice biometrics makes use of the distinctive traits of an individual’s voice, equivalent to pitch, tone, and speech patterns, to authenticate their identification. Customers can communicate a passphrase or repeat a selected phrase to realize entry to their accounts.

Enjoyable details: The Historical past Of On-line Banking

The historical past of banking app improvement might be traced again to the early days of the web and the rise of on-line banking. Here’s a timeline highlighting key milestones and developments within the historical past of banking app improvement:

-

Late Nineteen Nineties: On-line Banking Emerges – Within the late Nineteen Nineties, banks began providing on-line banking providers by web-based platforms. These platforms allowed customers to entry their accounts, view transaction historical past, and carry out primary banking capabilities equivalent to transferring funds between accounts and paying payments on-line.

-

Early 2000s: Cell Banking Begins – With the proliferation of cellphones, banks started to discover cell banking options. Initially, primary SMS-based providers have been launched, offering customers with the power to obtain account stability updates and transaction alerts by way of textual content messages.

-

2007: Introduction of the iPhone – The discharge of the iPhone in 2007 marked a major milestone within the improvement of banking apps. The iPhone’s contact display screen and superior capabilities paved the best way for extra subtle cell banking functions.

-

2008: App Retailer Launch – Apple launched the App Retailer in 2008, making a centralized market for cell functions. This opened up new alternatives for banks to develop devoted banking apps for iOS gadgets, offering customers with a extra seamless and feature-rich banking expertise.

-

2010: Android Market Growth – Because the Android platform gained recognition, banks began creating cell banking apps for Android gadgets, catering to a broader person base.

-

2011: Cell Funds and Wallets – The introduction of cell fee options, equivalent to Apple Pay (2014) and Google Pockets (2011), allowed customers to make funds utilizing their cell gadgets. Banks built-in these options into their apps, enabling customers to make purchases and switch cash conveniently.

-

2012: Responsive Design and Cross-Platform Assist – To accommodate the rising variety of cell gadgets, banks started adopting responsive design rules and creating apps that would adapt to completely different display screen sizes and resolutions. Cross-platform assist turned a spotlight, permitting customers to entry banking providers on each iOS and Android gadgets.

-

2014: Biometric Authentication – With the introduction of fingerprint sensors on smartphones, banks began incorporating biometric authentication into their cell banking apps. Fingerprint recognition supplied a safer and handy manner for customers to entry their accounts.

-

2015: Growth of Cell Banking Options – Cell banking apps expanded their functionalities past primary transactions. Customers gained the power to use for loans, open new accounts, handle investments, and entry customized monetary insights straight from their cell gadgets.

-

Current Day: Enhanced Safety and Superior Options – Present banking apps prioritize sturdy safety measures, together with encryption, multi-factor authentication, and real-time fraud detection. Additionally they leverage applied sciences like synthetic intelligence (AI) and machine studying (ML) to supply customized suggestions, digital assistants, and chatbot assist.